Context

This is not my attempt to regurgitate the recent events that have unfolded overseas. Instead, this is merely to provide content and information about the events leading up to this unfortunate event.

Russia has been arguing for years that Ukraine should be Neutral of Nato. I don’t have much clarity over the matter; why? It could be with the Orthodox views different from the West culture. To reclaim what was once Russia again? The list can go on.

Why would Russia now be invading Ukraine? Would-be suicide for him. He has it all, one of the richest and most powerful men on the planet. But Russia did have leverage over European Countries and The United States.

Sanctions on Russia positive:

Russia produces 10M + barrels of oil per day and has 2k tones of gold

Russia is the third-largest oil producer in the world

If oil goes up to $100 per barrel, Russia adds $3B a month.

If gold goes up 10%, Russia would be making $15 Billion

Russia profits off invasion at the expense of The United States and its NATO allies

Sanctions on Russia, Negative:

disconnecting Russia from the SWIFT System

Marking the end of USD Global Reserve Currency

an unknown amount of negative externalities never seen before

possibility pushing towards a Bitcoin or crypto rails of payment

SWIFT- is a transacting bank system used to move billions of dollars worldwide every day for 1st, 2nd, and 3rd world countries. Using it to disconnect Russia from the SWIFT system could bring fears and concerns of other nations being done the same in disconnecting them from the world economy. They have to search for further alternatives.

Failures of Europe, Germany, United States

German Economist, Minister Habeck, recently stated:

50% of our coal comes from Russia

55% of our gas comes from Russia

35% of our oil comes from Russia

The United States imports 595,000 barrels of oil per day from Russia. The Keystone XL Pipeline would have produced 830,000 barrels per day. The United States became reliant on Russia by choice.

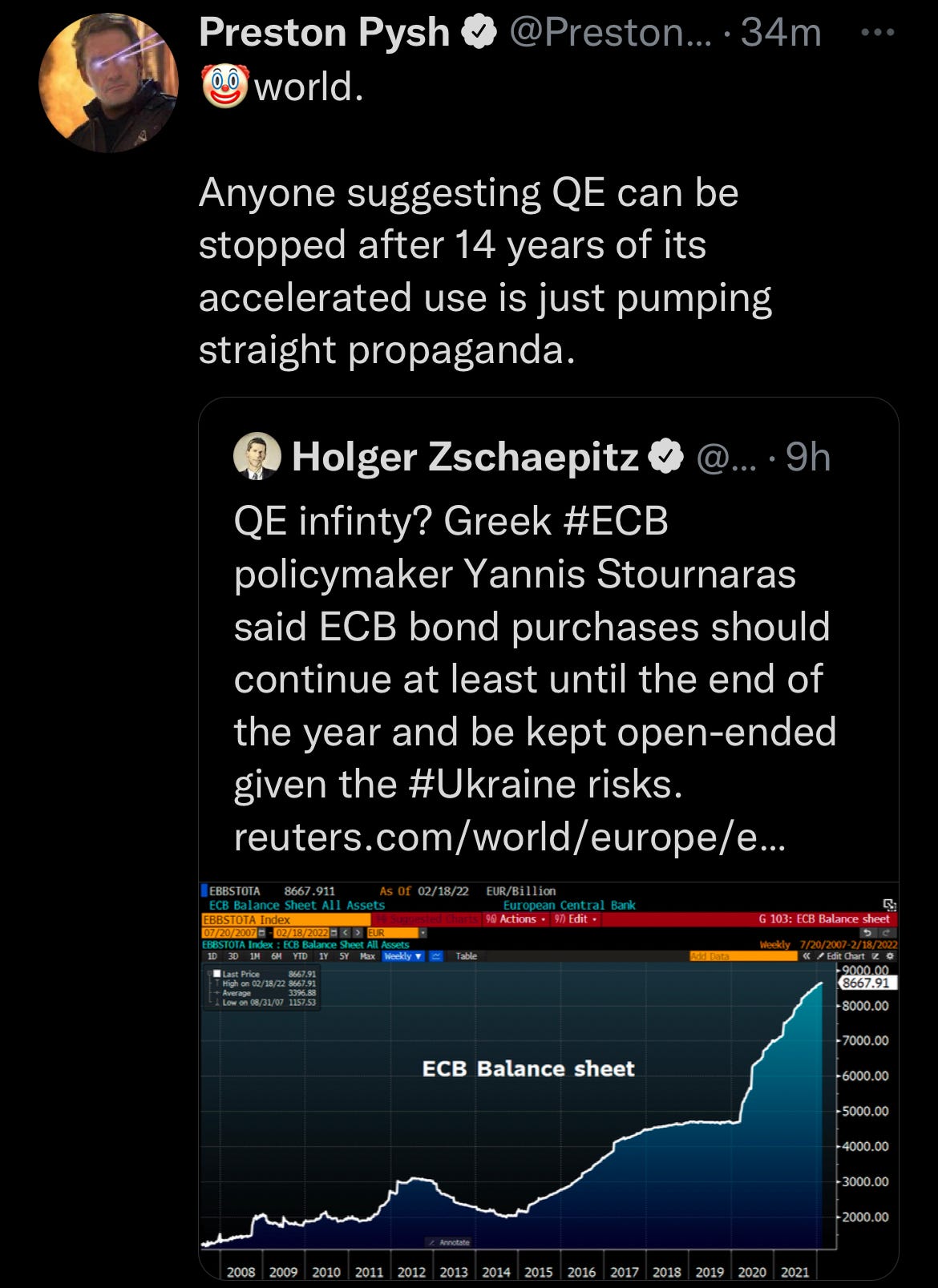

After Russia invaded Ukraine, many people demanded Europe stop buying natural gas. Instead, Europeans bought up more long-term Russian contracts. The White House even made a statement, “Our Sanctions are not designed to cause any disruption to the flow of energy from Russia to the world.”

These people were not serious about beginning with informing an effective response to Russia’s invasion.

Preventable?

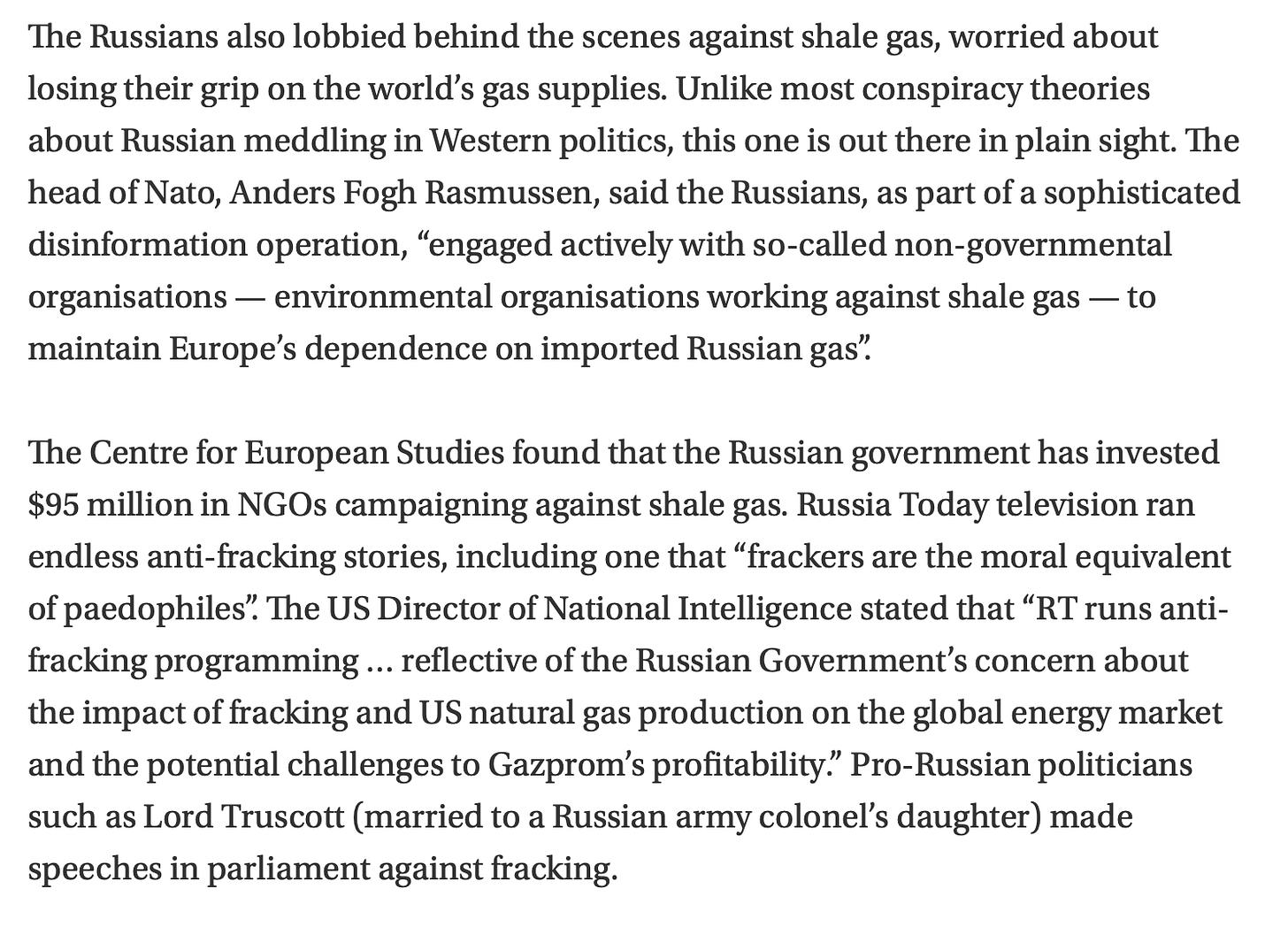

Start with the tight grip Russia had over Europe’s and the West energy supply that at the moment looked inevitable but was preventable. The reality is…

Germany has been shutting off its nuclear power plants to zero by the end of 2022.

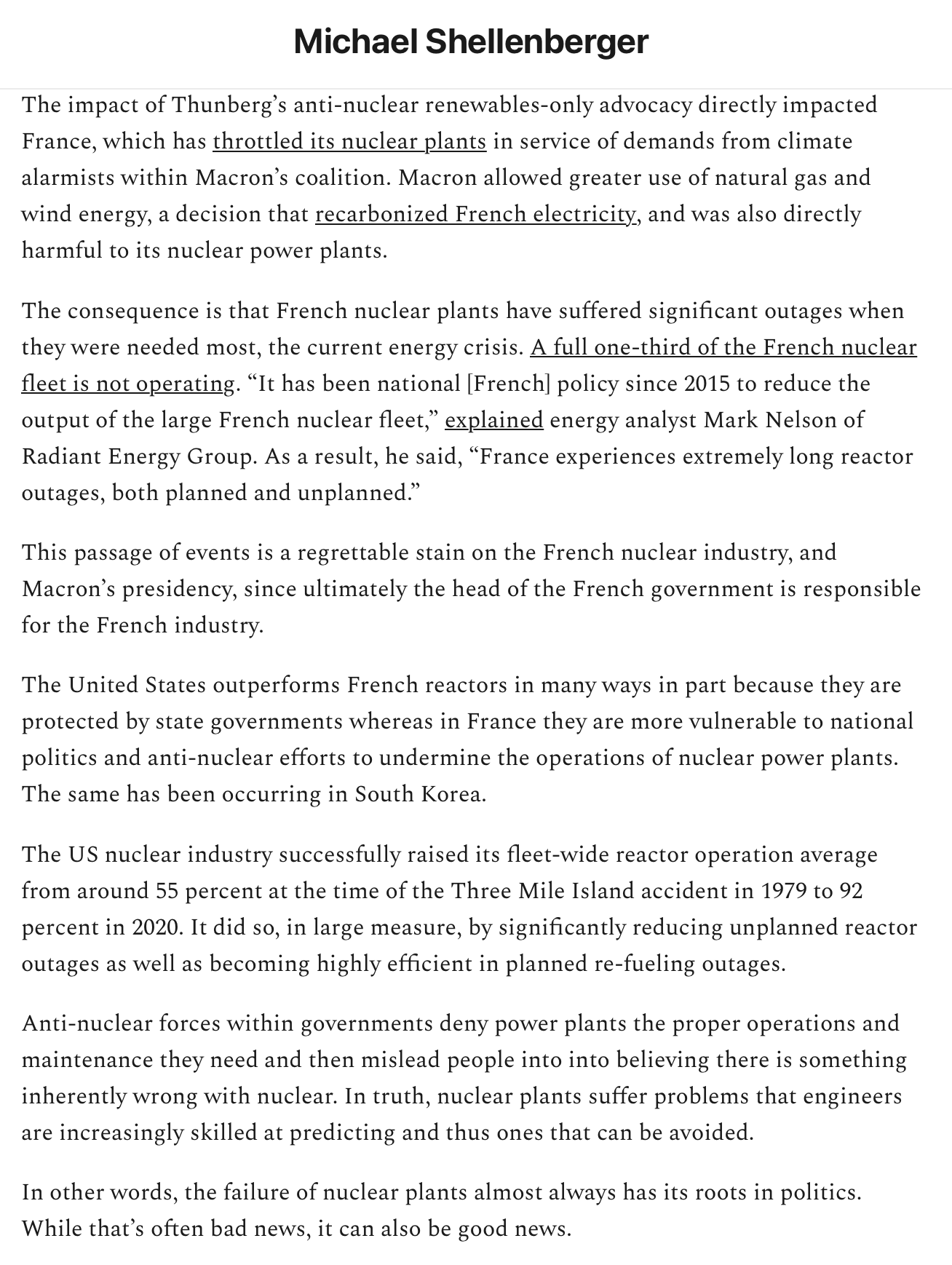

France has done the same in shutting down its nuclear plants

The United States shut down its Keystone XL Pipeline

Britain could have increased fracking for natural gas but chose not to.

Russia strategically played the Europeans and the West to depend on Russia to provide oil, energy, and natural gas. For NATO to appear pro- “climate change” and bend the knee to climate activists like Greta Thunberg.

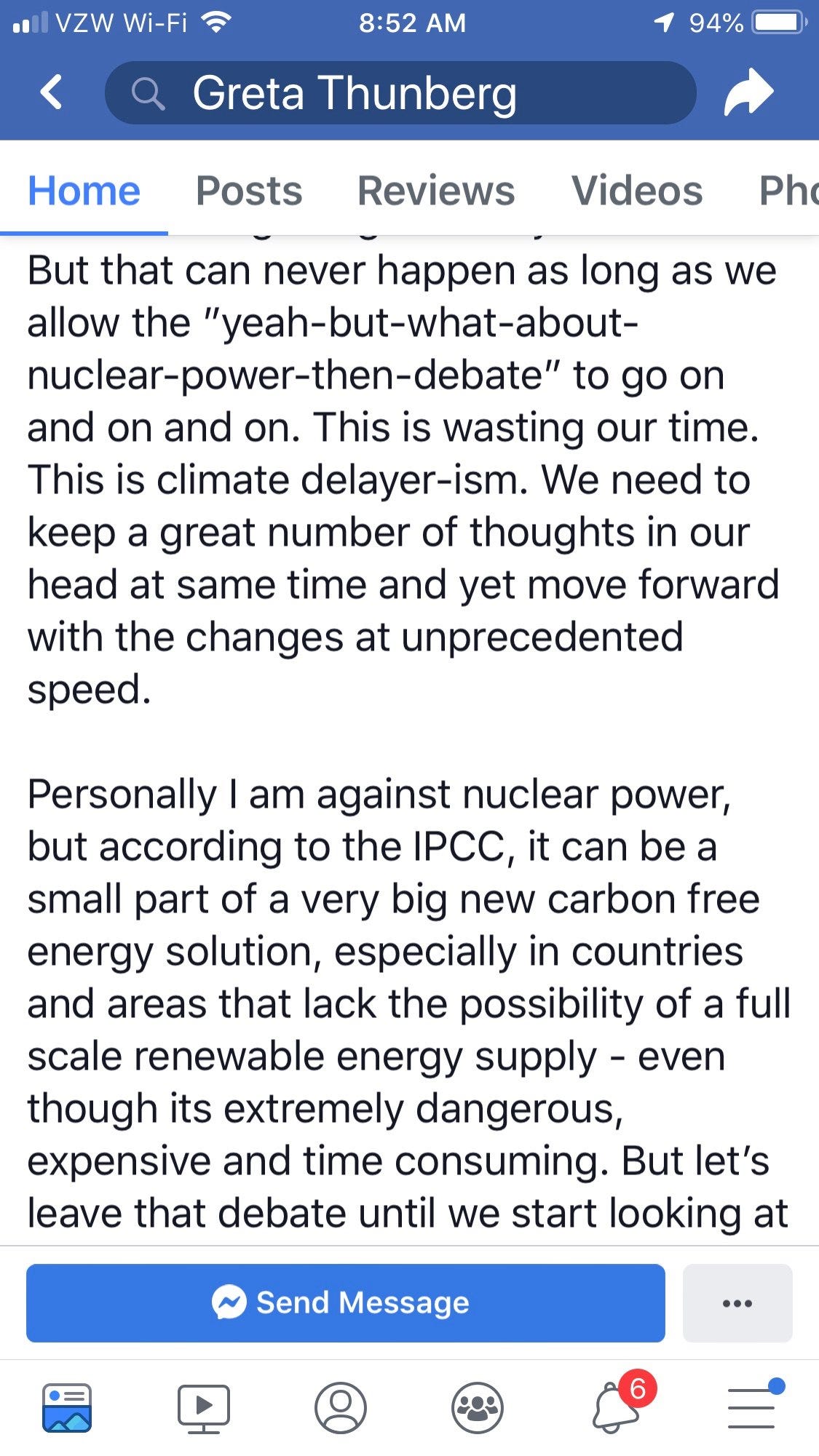

Here is Greta Thunberg’s response on Facebook to Nuclear Power Plants.

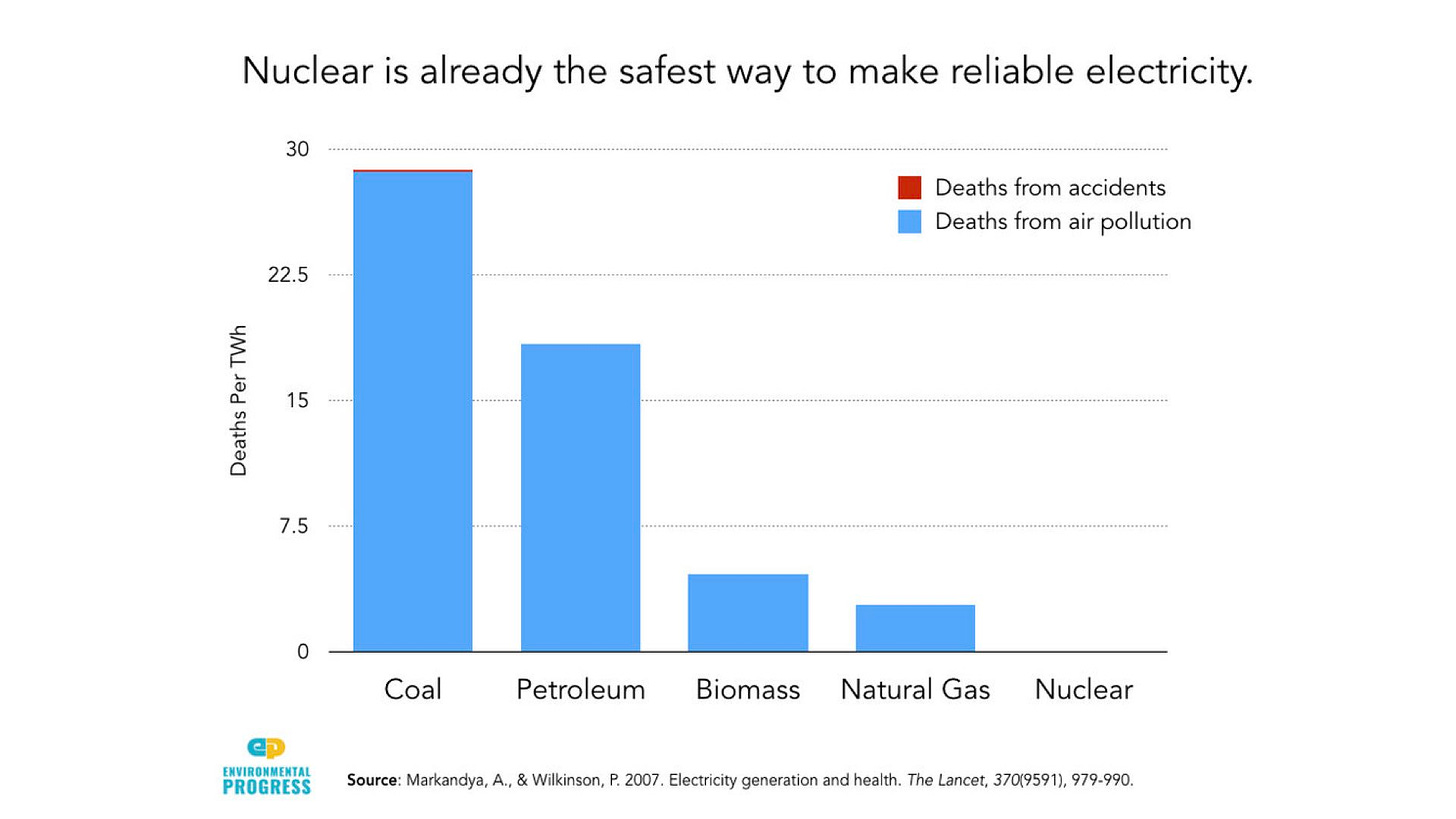

On the contrary to climate alarmists, Nuclear Power Plants produce near 100% pure, clean energy. Only when a Power Plant malfunctions or the plug is not pulled out in time, it causes an irreversible catastrophe. We have not explored/researched Nuclear Energy enough to understand and comprehend the extensive resources that could be captured and produced. Energy use is set to go up every year no matter what climate alarmists say; it is inevitable to decrease energy use because you withhold the acceleration of human ingenuity.

What to hold during times of war

Gold was the first to respond in light of the invasion into Ukraine, with Gold hitting near $2,000 by the morning, but its performance lasted for a couple of hours.

Perhaps these people spoke too soon. Bitcoin did dumb to the levels of $34,000 and rebounded back to $40,000. So the market indicated that maybe Bitcoin is better than Gold during times of crisis and war.

Do keep in mind, during times of war. The money printer goes BRRRRRR. The White House asks money for war, and in the likes of it, the FED would also not look to raise rates during the war, especially if the United States enters and becomes a part of it. For now, the United States is just supplying troops near Germany to provide support for NATO allies and helping upon aid for Ukraine.

Bitcoin is open to everyone, to my friends and enemies. I can not do anything to prevent or freeze any transactions they do. Bitcoin is designed that way. The internet is accessible to everyone and should be money open to everyone in the world. They have the right to their own money.

Try sending more than $100,000 worth of Gold bullion bars to Ukraine by mail during the war. It will either be seized or stolen during the war. The cost and risk are high. At the same time, Bitcoin is a near-instant payment system settlement.

The Ukrainian government and bank had long lines of people looking to withdraw their funds/money to preserve their wealth and flee the war. So there would also be a Bank Run…

Bitcoin was made to test times like these. When withdrawals from banks have mile-long lines, the banks no longer have sufficient funds; they can seize your gold/silver when crossing borders from allies and enemies. You can purchase Bitcoin without even having your phone, with just your digital wallet in mind, the “private keys,” a 12-word phrase in your head, you can cross borders without looking to carry cash, gold, silver, or property. All your wealth is in your mind, which you can re-access once you reconnect to the internet.

Bitcoin is looking to face an existential threat. If Russia does get boxed out of the SWIFT network, there is not a near-zero chance that it would not look to use Bitcoin as rails of payment across the network in use of liquidity and instant payment. Then Bitcoin will become heavily regulated; governments will push companies to prevent Russia from interacting with the Bitcoin network. Making the Bitcoin Block Size War in 2015-2017 look childish compared to this decade. Bitcoin has become strong enough to, without hacks and keep the network running at 100%.

Note* Christine Lagarde is set to be of the high class. She used to work for the IMF (International Monetary Fund), where she gave herself a nice payout on newly printed money. She did not serve any jail time. She is now President of the European Central Bank (ECB) and, just like the FED, is injecting the Markets of Europe with excess cash and rates below zero.

A situation in which Russia uses the Bitcoin Network can eventually kill the network in which the Blockchain splits into two. One is where Bitcoin is open to everyone, the other being a Bitcoin network that restricts transactions. Bitcoin will be tested, causing volatility and a lot more dips. But do not forget Bitcoin was said to be used by “criminals, right-wing, etc.” They can label Bitcoin as whatever they want. But it is freedom money.

Fix the Money, Fix the World

Russia-Ukraine