Events Unfolding

It is essential to highlight the events unfolding in Canada, where liberal democracy has fallen quickly into an authoritarian state similar to those they despise, like Russia and North Korea. Justin Trudeau, Prime Minister, issued an “emergencies act” that he and his party want to set as permanent law. So that the Government can freeze your account/funds generated from a non-profit organization, they will list labels of you when they disagree with the protest, and government can seize and destroy any of your property with no warrant but said word of PM and his “emergencies act.” A great argumentive piece from David Sacks from his work, “A Social Credit System Arrives in Canada.”

He says,

“For years, ideologues have used accusations of bigotry to hound people from their jobs, kick them off social media, and rescind their right to participate in the online economy. However, many observers shrugged off these cases as outliers-fringe examples that could be ignored because they affected unsympathetic individuals. But now we have a wide-ranging group of working-class people and their supporters who are being financially deplatformed for civil disobedience.”

If a Government or central entity can freeze and seize your money, is it your money to begin with? Your life’s work is all saved up, in which you have followed along in the rules, and just when you think Government is doing an over the reach of power and breaking the Constitutional Rights of individuals. It is the citizens’ right to keep the government in check; their duty is to maintain an authentic democracy and free market.

“Rights aren’t rights if someone can take them away. You don’t have rights, you have temporary privileges the government can take away at any time.” - George Carlin

Amid a war between Russia and Ukraine, the United States is threatening economic sanctions on Russia and removing them from the SWIFT system. If Russia looks to invade Ukraine, sanctions are imposed for enemies of war, but in recent events, Canada has levied those same sanctions unto their people. If these are liberal democracies, we have a decade of pain to come.

People are waking up in Canada in light of the actions taken by the government, which can be deemed an overreach of power. David Heinemeier Hansson, co-founder of Basecamp, from his work titled “I was wrong, we need crypto,” finds humility in accepting that the people he was arguing on the internet with laser eyes were right all along about government and being financially free from that same government.

In his work, he wrote,

There’s just so much to oppose: Bitcoin’s grotesque energy consumption, the ridiculous transaction fees and low throughput, the incessant pump’n’dump schemes in shitcoins, the wild price swings in the main coins, the obvious fraud that is Tether, the lack of real decentralization in the most current web3 infrastructure, and on, and on, and on.

Beyond all these very real problems and challenges, my bigger beef was actually fueled by a lack of imagination. I could see the fundamental promise of a digital currency free of banks if you were living in a failing state like Venezuala or an overtly authoritarian one like China or Iran, but how was this relevant to the vast number of Bitcoin boosters living in stable Western democracies governed by the rule of law? Beyond the patina of philosophical respectability, it could apply to yet another get-rich-quick scheme?

It takes a lot of humility to come to grasp the fundamentals of Bitcoin and to realize that this sort of technology is for everyone around the world, not just those in third-world countries. Although it does take time to come to your senses, some unforeseeable actions in today’s moment can trigger one to realize what government is capable of.

Furthermore, he writes.

“I still can’t believe that this the protest that would prove every Bitcoin crank a prophet. And for me to have to slice a piece of humble pie, and admit that I was wrong on crypto’s fundamental necessity in Western democracies.

And it was the Canadians who brought this on? You might as well have told me that it was really the Care Bears who ran Abu Ghraib

Especially since I had some sympathy with fears projected by the US progressive left who spent four years fretting Trump might pull stunts like these. Then it turns out that the worries of an authoritarian overreach would be fulfilled by Trudeau to the North instead? Who’s writing this script? M. Night Shymalan?

Meanwhile, plenty of American commentators are cheering this on. Those terrible, horrible, no-good, very-bad truckers got what they deserved! To protest for a repeal of pandemic restrictions, so as to live the life enjoyed in Denmark by a population less vaccinated than the Canadians? That’s clearly beyond the pale!

But in a weird way, I’m glad we all got this warning from Trudeau in Canada and not Trump in America. It would have been far too easy for Europeans in particular to dismiss authoritarian assertions of martial law from Trump as being irrelevant to the European experience. Just like I had for so long deemed the practical desire of people in Venezuela or Iran or China for crypto irrelevant to the entire Western experience.

Is France really that different from Canada? Is Austria? Is Denmark? This is a real wakeup call”

Bitcoin is freedom money. Now you witness the tyranny of the Government in freezing accounts of fiat currencies for their citizens without issuing warrants or going through the courts. What do you think happens when the government rolls out its digital currency? Like Bitcoin? Not really. It’s far from being like Bitcoin but will use similar technology to issue digital tokens.

Central Bank Digital Currency (CBDC)

A Central Bank Digital Currency is the digital token issued by central banks, in which the value is pegged to the country’s fiat currency; Dollar, Euro, Yen, Peso, Bolivian, etc. A CBDC is issued and regulated by the nation’s monetary authority or central bank. They incorporate the government in the central bank or become the central bank. The issuers of said CBDC are the judges in allowing certain transactions, they can prevent/freeze transactions, and finally, they can quickly identify you. Ultimate surveillance of your day-to-day transactions.

Technology has allowed a credit-based system from physical(paper) fiat(Dollar, Peso, etc.) to balances and transaction records digitally. Especially with the Covid Crisis, it has amped digital transacting upon purchase of goods. For a deep thought on how Bitcoin is natively digital, meaning it was born into existence on the internet, making it essentially the internet of money. It is leaping over today’s fiats currencies and future CBDC advancements by decades.

Goals of CBDC’s

In the United States, nearly 5% do not have traditional bank accounts. 20% of citizens have bank accounts but use check-cashing services, payday loans, and money orders. CBCD’s would connect businesses and consumers into a network system:

financial security

accessibility

convenience

transferability

decreases cross-border payments

reduces maintenance on old financial system requirements

It does come with the benefit of being less volatile than other cryptocurrencies, in which CBDCs have to measure the financial stress of volatility in value. A CBDC also gives the entity the ability to change monetary policy and increase its token, bringing about inflation.

For those who do not know what Monetary Policy means. It is the set course of how much money will be printed physically/digitally.

For example, “The United States will issue only 1 Billion Dollars for all of its citizens, and we will print no more for centuries to come.”

Monetary Policy constantly changes because politicians from both sides of the aisle are the ones who frequently move the goal post. They print more through crisis, war, and bailouts. Bitcoin, on the other hand, its monetary policy has not changed and will not be changed from only the existing 21 Million Bitcoin.

Keep your head on a swivel.

Do keep in mind if the government is working for you or looking to control you.

Banks worldwide lobby the governments by funding campaigns to have insider trading access, permits, regulations lifted, etc.

They are speaking it out truthfully in having governments become the guidelines for spending your money. Is it yours? It feels more like enslavement but digitally. They are placing restrictions and borders in the digital realm.

Although what social media is saying about him, his podcast is controversial to today’s society. The Gentlemen he is interviewing points out some crucial details about CBDCs that past books have written about.

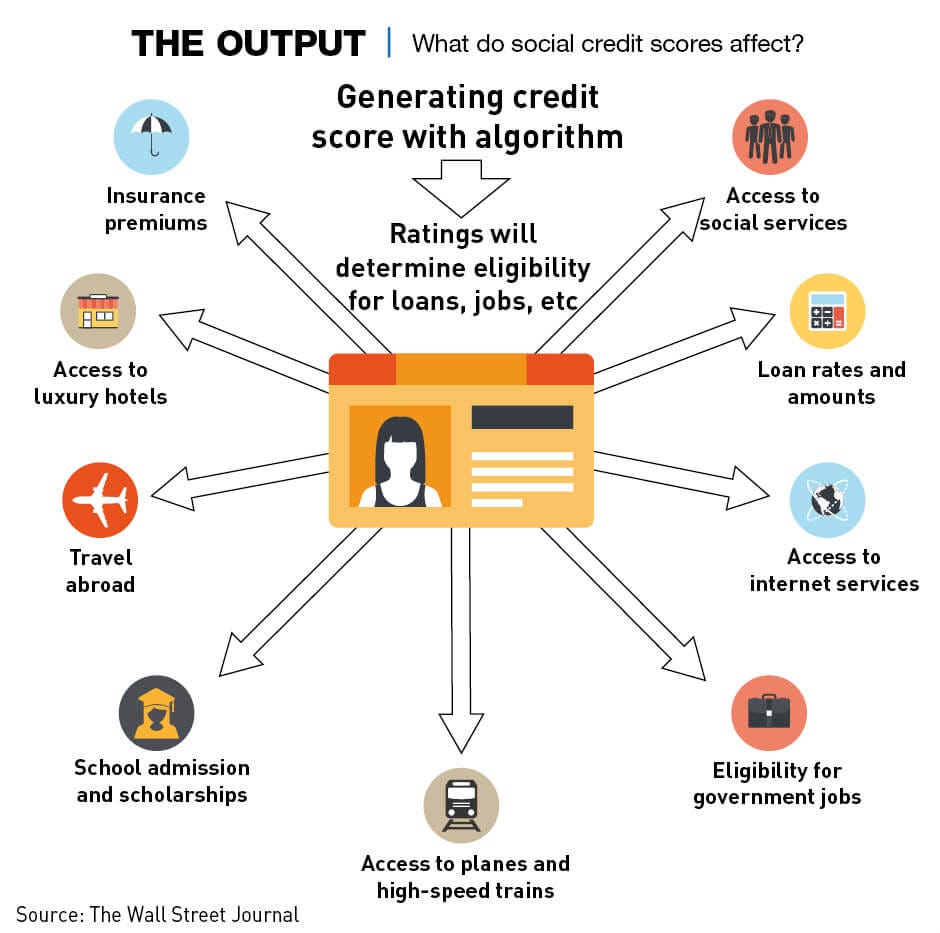

Governments with the CBDC can connect your digital money to your social credit score. If you do not follow along, they can neglect or freeze accounts much quicker digitally than traditional banks.

It is time to separate money and state(Government, Central Banks).

Like in the United States when we had the separation of Religion and State. The time has come now in which governments need to take a back seat on monetary policy because all they have done is inflate the money supply and $30 Trillion in debt.

CBDCs would give the government virtually complete control over the monetary system… but from an individual’s perspective, a CBDC would be a historic blow to privacy and individual liberty” - Joseph Wang

Pay close attention! Bitcoin was made to free everyone financially.

Fix the Money, fix the World.

Share this post