$100 Barrels of Oil?

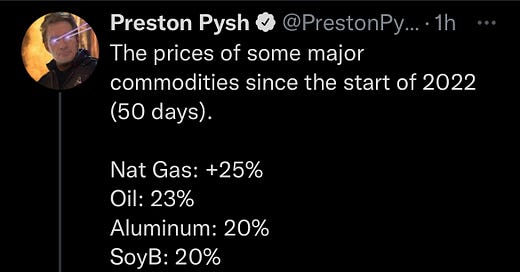

In light of the market tanking due to the fears of FED’s (9) rate hikes set to be dispersed in the year of 2022, inflation numbers hitting 7.5% as of January of 2022, and talks of Russia and Ukraine going to war.

The United States has moved away from the independence of natural oils and gases to becoming dependent on importing natural sources. In addition, the United States has become dependent on the consumerism of its citizens to drive up its GDP. They export cheap labor into other countries to consume material things every year.

I remember President Trump introduced a Keystone XL Pipeline in partnership with Canada to bring fossil fuel, oils, and gases into the markets. Flooding the supply vast enough for prices to drop. When you inflate the supply, you reduce cost because of the abundance of natural oils, meaning the lower cost of electricity and gas prices. Instead, the United States is reaching into its reserves to supply its citizens with electricity and gas. Because in the first weeks of Biden entering in office, he signed an executive order terminating the Pipeline and destroying a few hundred jobs.

Turns out…

As Oil Nears $100, Saudis Snub U.S., Stick to Russian Pact Amid Ukraine Crisis.

Saudi Arabia is no longer looking to keep the deal or listen to Biden to increase oil pumping to reduce gas prices. They have spoken up, which is most likely to hit $100 barrels of oil in these next coming months. Meaning you will see gas at $5 a gallon or up to $6 a gallon, do not be surprised. When the United States does not have a replacement for oils and natural gases set and firm, but what to move onto a standard of climate change, it shows what will happen for the people in the markets. Solar Panels and Wind Farms do not produce ENOUGH ENERGY FOR THE GRID. The duality of the United States is to appear as virtue signaling towards saving the planet, but its actions say different; they depend on Saudi Arabia to pump more oil.

It would be beneficial to invest any of the Top 2 commodities in the light events of Saudi Arabia and Russia-Ukraine war talks.

The recent events are part of a game theory of nations taking their place and showing the world what they are capable of. The United States can sanction Russia economically and disconnect their markets from the world. Saudi Arabia took the backseat on pumping oil and allowed Russia to be the primary provider of exporting energy and gas. Russia does not need to sell its energy/gas in dollars(world reserve currency); it can sell its energy/gas in Bitcoin.

I see $100 barrels of oil and $6 a gallon at gas tanks. I am calling a bluff on the FED’s raising nine rate hikes.

But the actual news that should be spread and discussed is Canada's sanctions on its citizens. I do not think everyone is aware of the terrible actions the government is taking in freezing bank accounts; the money of individuals. It is grotesque of a liberal democratic country, which is a democracy a government is supposed to defend individuals' rights.

I fear to say… nothing good in history has come from the government issuing an “emergencies act” with unlimited power not vested by law. If history proves anything, it gets implemented as law without votes.

Share this post