I have been driven into writing this in pursuit of expanding financial literacy. Something that I felt was missing in my teachings while growing up. One where I dropped out of college in the quest of understanding how the World’s financial system works. It took a lot of time, and it brought me down many rabbit holes that can not be explained in one article but are expanded over vast pieces of literature. Through Bitcoin, I have found all the answers and the solution to the inequality of life. I need to teach money and financial literacy to make it a common language. May this pursuit take me down a road of discovery and understanding that I have been in search of.

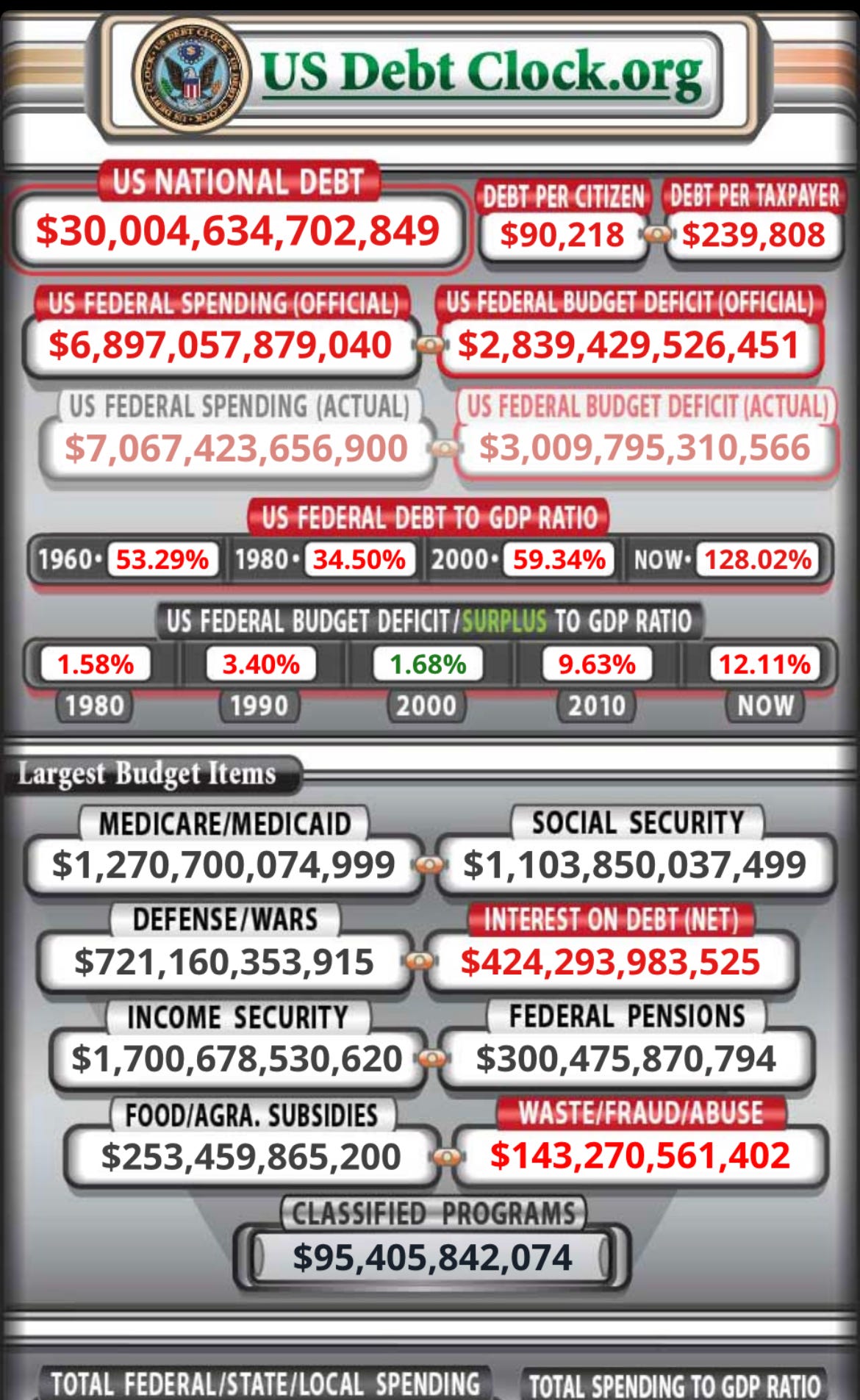

As of February 1, 2022. The United States has surpassed a US National Debt of $30 Trillion. An amount that is for sure not looking to be paid off at all this decade or the next. For reference: I use the US DEBT Clock .org

To understand the financial system today, you will have to dive into the debt of today’s government and governments of other nations. It is built on top of a fiat system.

Fiat, for example:

a formal authorization or proposition; a decree

The Dollar is based on legal tender laws. Meaning the US government makes the dollar the official money to pay off the debt owed to the United States. You can not pay the US in any other currency. But our financial system is more complicated than that. The FED, a Federal Reserve system, has a central hub of control that has no connection to the government. It is a central banking system that the United States uses and declares the dollars that flow from the FED as the official currency in the United States. But central banks and the US government are mostly asking for credit and loans.

Martkets Today = Casino

We have created a fiat system built inside a capitalist economy on a false indication of a free and open market. It is not free and open to the citizens of the United States when some 45% of are not invested in the United States Market. There is insider trading allowed. Politicians who buy stakes in companies that will benefit from policies set to pass where they will receive funding from the government, called Government contracts and benefits. The Markets today are a casino, a side product of fiat. It is not open to all before and after hours of the market.

For example:

Snowball Keeps Rolling

We have entered the housing crisis in 2008/2009. The spending after that crisis asked by Congress was $475 Billion. Meaning bailouts for Banks and Wallstreet that got wrecked from the housing market. In a free and open capitalist market, you let those Banks and Wall street Hedge funds blow up, no bailouts or saving for anyone when printing money. But to keep the short suffering and devastation of a few groups of people making the wrong investments, the $475 billion passed by Congress just certified that you will be saved by printing the money if you make a terrible investment. You naturally have to allow the temporary pain of job losses and bad investments so that the markets can further correct themselves into equilibrium.

Essentially the dollars are not backed by anything. They are not pegged to anything. What creates value today is debt. You ask for more money through loans or credit to fuel the price of things.

Side Effects of Fiat

Most politicians do not have your thoughts in mind. They speak and talk for your votes, but in the end, they make policies that cost their citizens more grief and pain. Things become insolvent in this fiat world, meaning they go “bankrupt,” as reported for Israel this year. Meaning they need more cash; to get more, you have to print more. It’s a never-ending game of printing and printing. They are creating more inequality and disparity for the citizens of the world.

The government no longer has the right to print money due to the constitution. So they established the FED (Federal Reserve). So they have the first rights to the capital and its distribution, creating the Cantillon effect.

a change in relative prices resulting from a change in money supply, which 18th-century economist Richard Cantillon first describedIt is an inflationary world, meaning commodities (stocks, oil, gas, real estate) go up (Gold, Silver). Because the new money that is printed is parked in the essential things and assets because they are of a limited amount; houses, gold, silver, gas. Those closest to the printing machine have the first rights to the money and its distribution, creating the Cantillon effect. That is how wealthy people remain wealthy. But remember, it is not an open and unrestricted market because most people do not have access to these luxurious commodities or assets. Not even third-world countries, but we have to print more to get them out of poverty?

Once new money is printed, everyone wants a piece of the pie or, in this case, the $729 Billion that is said to get passed by Congress for the aftermath of Covid. So citizens ask for demand in wages, you see Corporations raise subscriptions and prices. Small businesses also grow their food prices to compete with other small businesses.

This Fiat system of printing money has brought more pain and inequality. They are getting the cost of living much higher, with housing going nearly 40% up every year. While the average wage only goes up 3%. Not even including the rise in food, gas, electricity, etc.

The US Dollar is the world reserve currency, second and third-world countries have to use dollars to trade and benefit from the US. It is a monopoly on money. These second and third-world countries have to take out loans and credit from central banks like the IMF and FED in dollars to grow their economies while competing with assets and commodities rising (inflating) from 3%-200%. It is a challenging game in which the rules are well defined, and you have to beat inflation year per year to live a decent financial life.

Inflation- is the value of your dollars at hand withering away, in which you need more dollars to purchase goods and services—making it difficult even to have a saving account when you can at least make more in the stock market.

ENTER BITCOIN

I am set to prove that scarcity has value and can bring everlasting abundance than fiat money. You will not need more Bitcoin to buy goods. It is open to everyone and does not discriminate. It is of its first kind, an honest monetary system that allows borderless transactions across the world at a low cost. It is being made accessible to everyone in the world. It gives them a bank for those unbanked, especially if you have been following up on El Salvador, which will be another piece that I will publish. Bitcoin can essentially be set as the internets Money. Not one body or group of people can control it. No CEO, no LEADER. There will only ever be 21 Million Bitcoin. It is a resemblance to what real money is made digitally. No Cantillon effect; everyone must compete to get Bitcoin. There is no free pass or saving of Bitcoin loss when doing futures.

-It is the natural tendency of scarce commodities referring to this graph. It is NUMBER GO UP technology that you can own and store for a decade or more.

Bitcoin is still at the early stages of being adopted on the world stage as a commodity or currency. You can buy a fraction of a Bitcoin. On “Strike,” you can purchase up to .50 cents of a Bitcoin.

-Do try to look up terms if you do not understand. It is essential to understand the lingual of finances to further your understanding of money and how the financial system works. To repeat and use the terms yourself when talking to others. And also ask questions. Never be afraid to ask any questions. It gets you on the right path and in the right direction-